SUBSCRIBE

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

Dianne Williams Wildt, MBA

Certified Retirement Counselor®

Since 1983 in the financial services and investment industry

Retirement Pathways, Inc.

4500 Bowling Blvd., Suite 100

Louisville, KY 40207

Phone: 502-797-1258

Email: dianne@retirementpathways.com

Website: www.retirementpathways.com

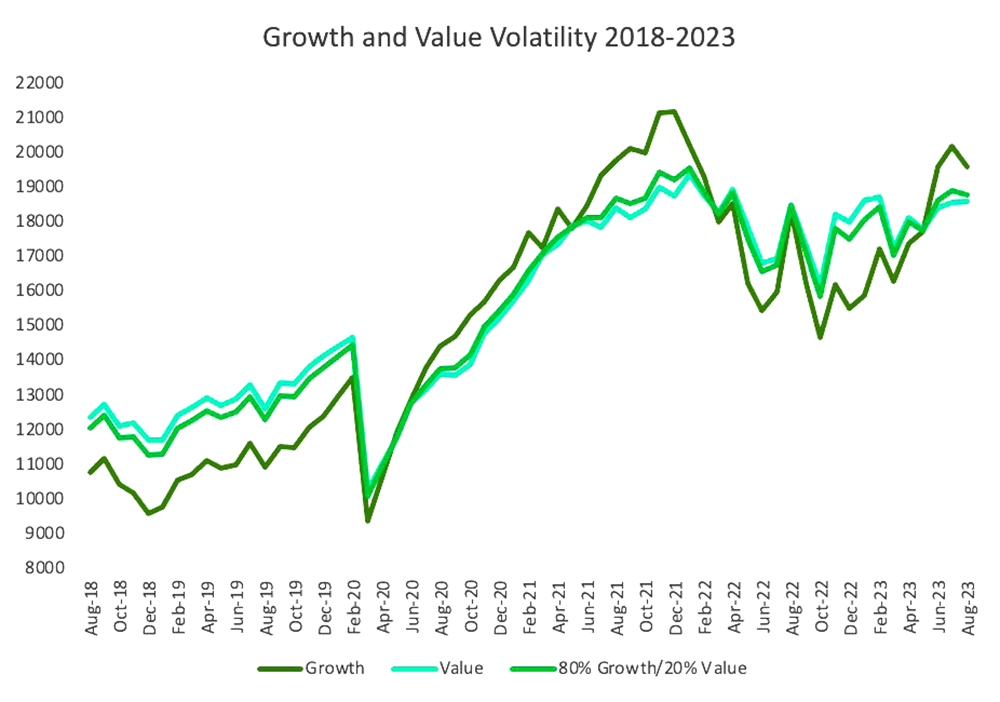

The 2022-23 inflation spike and accompanying stock volatility spurred many investors toward high-yield fixed-income investments as risk protection for their portfolios. But with core inflation edging lower and stock volatility more in hand, you may want to look at another investment—value stocks—to diversify* your portfolio further in 2024.

Value stocks are frequently linked to solid, well-established businesses that operate in dependable sectors. Although their development rates may be slower, they are seen as financially reliable and may be undervalued by the market. Growth stocks are often found in sectors with strong growth potential, such as emerging markets, healthcare, or technology. These businesses may have greater volatility because they are frequently in their early phases and reinvesting profits in growth.

What reduces the volatility and risk of value stocks? While their potential for capital appreciation may be moderate, they often offer steady income through dividends. In addition, the issuing company is already established and may have overcome many risks start-up or infant companies face. Meanwhile, growth stocks carry higher risk due to their higher volatility and market expectations.

While they offer the potential for significant capital appreciation, they may also experience greater price fluctuations and have a higher chance of underperforming during market downturns.

*Diversification cannot eliminate the risk of investment losses. Past performance won’t guarantee future results. Investing in stocks or mutual funds can result in a loss of principal.

Source: Wiltshire Growth and Value Total Market Indices, Economic Research Division of the Federal Reserve Bank of St. Louis and LTM Marketing. Note that you cannot invest directly in an index.

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

Investment advisory services offered through American Capital Management, Inc., a State Registered Investment Advisor. Retirement Pathways, Inc. is independent of American Capital Management, Inc.

Retirement Pathways, Inc. and LTM Marketing Specialists LLC are unrelated companies. This publication was prepared for the publication’s provider by LTM Client Marketing, an unrelated third party. Articles are not written or produced by the named representative.

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.