SUBSCRIBE

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

Dianne Williams Wildt, MBA

Certified Retirement Counselor®

Since 1983 in the financial services and investment industry

Retirement Pathways, Inc.

4500 Bowling Blvd., Suite 100

Louisville, KY 40207

Phone: 502-797-1258

Email: dianne@retirementpathways.com

Website: www.retirementpathways.com

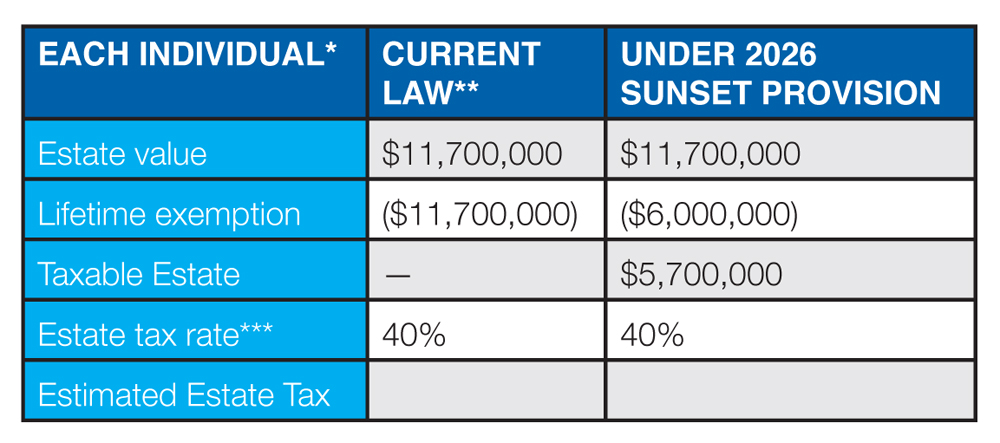

Forewarned is forearmed. Unless Congress passes new estate-tax legislation, the historically high estate-tax exemptions for 2024 and 2045 will be just that—history—at the end of 2025 (see table). What might you do to take advantage of the higher exemptions before it’s too late?

Start by making lifetime gifts in 2024 and 2025—Gifting to your loved ones and charities assets while alive to enjoy seeing your gifts improve their lives and support your causes.

Review your personal gift program—If it works for you, maximize your personal gifts in 2024 and 2025 to reduce your estate for 2026. In 2024, the annual gift-tax exclusion lets you give up to $18,000 (estimated) free of estate and gift tax to as many individuals as you like. Gifts you make directly to medical providers and educational institutions for tuition on behalf of parents or grandchildren, for instance, are another way to downsize your estate to avoid future taxes. This exclusion is in addition to the annual gift-tax exclusion.

Consider making some charitable contributions planned for the future now—If you can, without affecting your charitable contribution income-tax deduction, make higher contributions to your favorite charities in 2024 and 2025.

Don’t shortchange yourself—Avoiding or reducing tax isn’t everything. Before setting out on an estate-tax-cutting campaign, arrange to carefully analyze your situation with your professional advisor to ensure you’re keeping enough to maintain your lifestyle amid potential future inflation and volatile markets

* Except for tax rate, amounts would be doubled for a married couple.

** As of publication production.

*** A flat rate is used for illustrative purposes.

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

Investment advisory services offered through American Capital Management, Inc., a State Registered Investment Advisor. Retirement Pathways, Inc. is independent of American Capital Management, Inc.

Retirement Pathways, Inc. and LTM Marketing Specialists LLC are unrelated companies. This publication was prepared for the publication’s provider by LTM Client Marketing, an unrelated third party. Articles are not written or produced by the named representative.

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.