SUBSCRIBE

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

Beth A. Botti, CFP®, ChFC, CLU, CDFA™

Financial Consultant

California Insurance License #0G24537

612 Wheelers Farms Road, Milford, CT 06460

Phone: 203-877-6556 Ext. 169

Fax: 203-301-0736

Email: beth.botti@equitable.com

Q. I understand the importance of beginning my retirement saving as early as possible, but it’s difficult when I’m just starting out. I’ve heard I could get part of my retirement plan contributions back by claiming the “saver’s credit” on my federal income tax return. Could you tell me more about this?

A. When contributing to an individual retirement account (IRA) or employer-sponsored retirement plan, investors under a certain income level can benefit from a saver’s credit of up to $1,000 for single filers and $2,000 for married couples filing jointly. The amount of the credit reduces your tax liability by the same dollar amount.

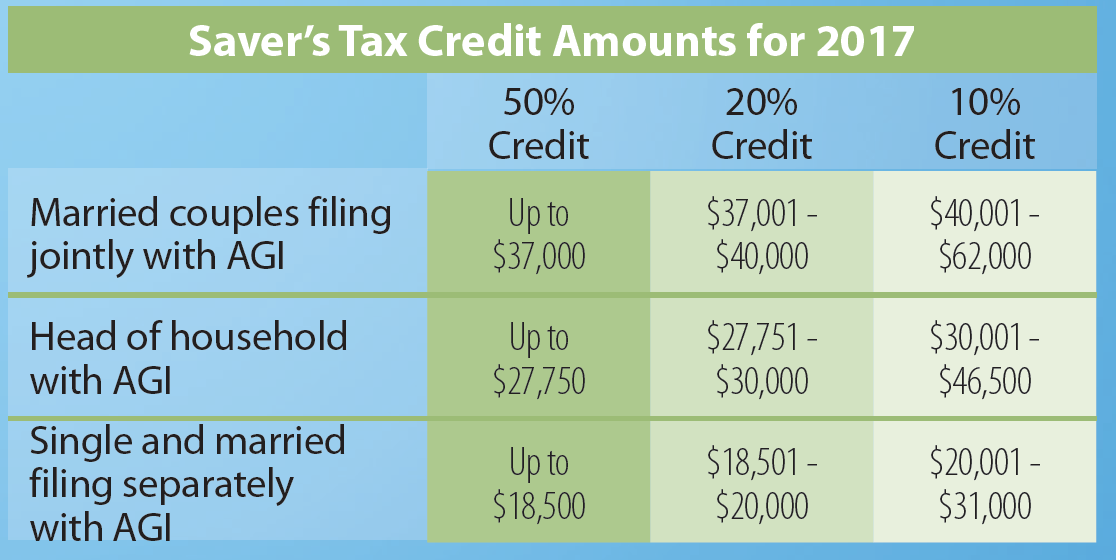

The amount of the credit is 50%, 20% or 10% of up to $2,000 ($4,000 for married couples filing jointly) in contributions, depending on your adjusted gross income. The lower your income, the larger the percentage of the contribution you can take as a credit. To be eligible for the saver’s credit, you must be 18 or older, not a full-time student and not claimed as a dependent on someone else’s tax return.

Rollover contributions consisting of retirement funds that you moved from another retirement plan or IRA don’t qualify toward the credit. And any taxable distributions you received from your retirement plan or IRA during a defined “testing period”* may reduce your eligible contributions.

You’ll have to fill out Form 8880 (Credit for Qualified Retirement Savings Contributions) and include it with your federal income tax return to receive the credit.

* Generally, the “testing period” consists of (i) the two years preceding the year for which you are claiming the saver’s credit, (ii) the year for which you’re claiming the credit and (iii) the period after that year up to the due date (including extensions) for the tax return for that year.

Enter your Name and Email address to get

the newsletter delivered to your inbox.

Please include name of person that directed you to my online newsletter so I can thank them personally.

Enter your Name, Email Address and a short message. We'll respond to you as soon as possible.

Duly registered and licensed financial professionals offer securities through Equitable Advisors, LLC (NY, NY 212-314-4600), member FINRA,SIPC (Equitable Financial Advisors in MI & TN), offer investment advisory products and services through Equitable Advisors, LLC, an SEC-registered investment advisor, and offer annuity and insurance products through Equitable Network, LLC (Equitable Network Insurance Agency of Utah, LLC in UT; Equitable Network of Puerto Rico, Inc.). Equal Opportunity Employer - M/F/D/V. Equitable Advisors and its associates and affiliates do not provide tax, accounting, or legal advice or services. Representatives may transact business, which includes offering products and services and/or responding to inquiries, only in state(s) in which they are properly registered and/or licensed. Your connection to this website does not necessarily indicate that the sender is able to transact business in your state. The information in this website is not investment or securities advice and does not constitute an offer. For more information about Equitable Advisors, LLC you may visit https://equitable.com/crs to review the firm's Relationship Summary for Retail Investors and General Conflicts of Interest Disclosure.

GE-6572038.1 (4/24)(Exp. 4/26)

CFP®, and CERTIFIED FINANCIAL PLANNER™ are certification marks owned by the Certified Financial Planner Board of Standards, Inc. These marks are awarded to individuals who successfully complete the CFP Board's initial and ongoing certification requirements.

www.equitable.com

Check the background of this investment professional on FINRA's BrokerCheck

Equitable Advisors, LLC and LTM Marketing Solutions, LLC are unrelated companies. This publication was prepared for the publication’s provider by LTM Marketing Solutions, LLC, an unrelated third party. Articles are not written or produced by the named representative.

The information and opinions contained in this web site are obtained from sources believed to be reliable, but their accuracy cannot be guaranteed. The publishers assume no responsibility for errors and omissions or for any damages resulting from the use of the published information. This web site is published with the understanding that it does not render legal, accounting, financial, or other professional advice. Whole or partial reproduction of this web site is forbidden without the written permission of the publisher.